Dashboard Studio is an embedded fleet analytics tool in Navixy that enables teams to build custom panels for their workflows and KPIs, without external services or BI projects.

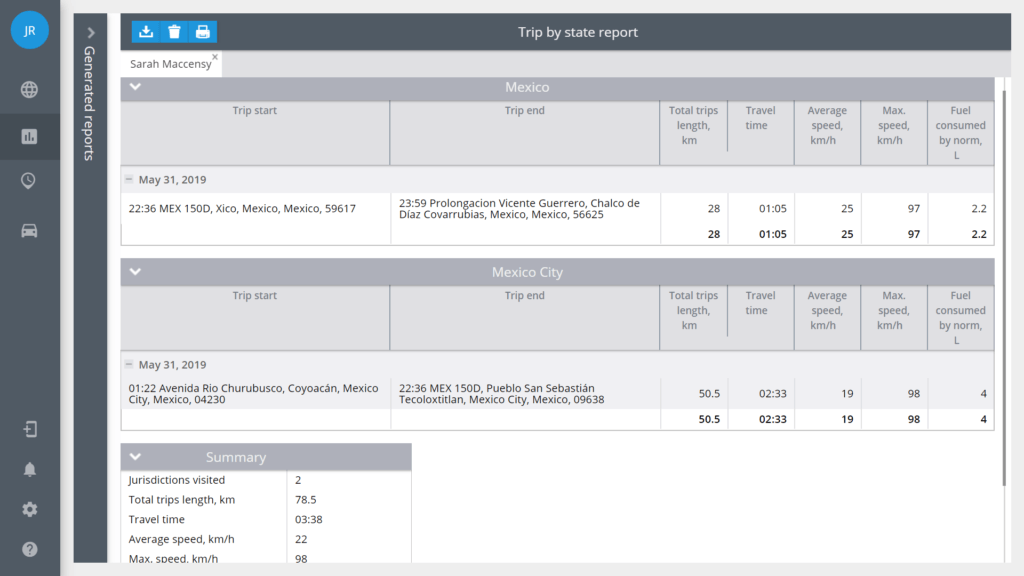

The Trips by state extension is developed to simplify the reporting of fuel use by motor carriers that operate in more than one jurisdiction. Take advantage of our fuel tax report, listing all miles traveled on the roads in each state.

Consider using Trips by state to:

- Easily get a refund on the fuel taxes that were paid in each region

- Provide IFTA reporting to the Department of Transportation. The report automatically collects mileage data for each state by integrating seamlessly with your tracking device

- Accurately calculate shipping costs. Our extension uses the odometer value to determine how far fleet vehicles have driven. The telematics data will help prove shippings to remote regions and extra costs